Are you looking to move into a beautiful and vibrant community like Paumanack Village Greenlawn? With its stunning natural surroundings and top-notch amenities, it's no wonder why many people are eager to call this place home. However, the application process can be daunting, especially if you're not familiar with what to expect. In this article, we'll guide you through the top 5 ways to ace your Paumanack Village Greenlawn application and increase your chances of getting approved.

Understand the Application Process

Before we dive into the top 5 ways to ace your application, it's essential to understand the application process itself. The Paumanack Village Greenlawn application typically involves several steps, including:

- Initial application submission

- Review of credit history and financial documents

- Rental or purchase agreement review

- Approval or denial notification

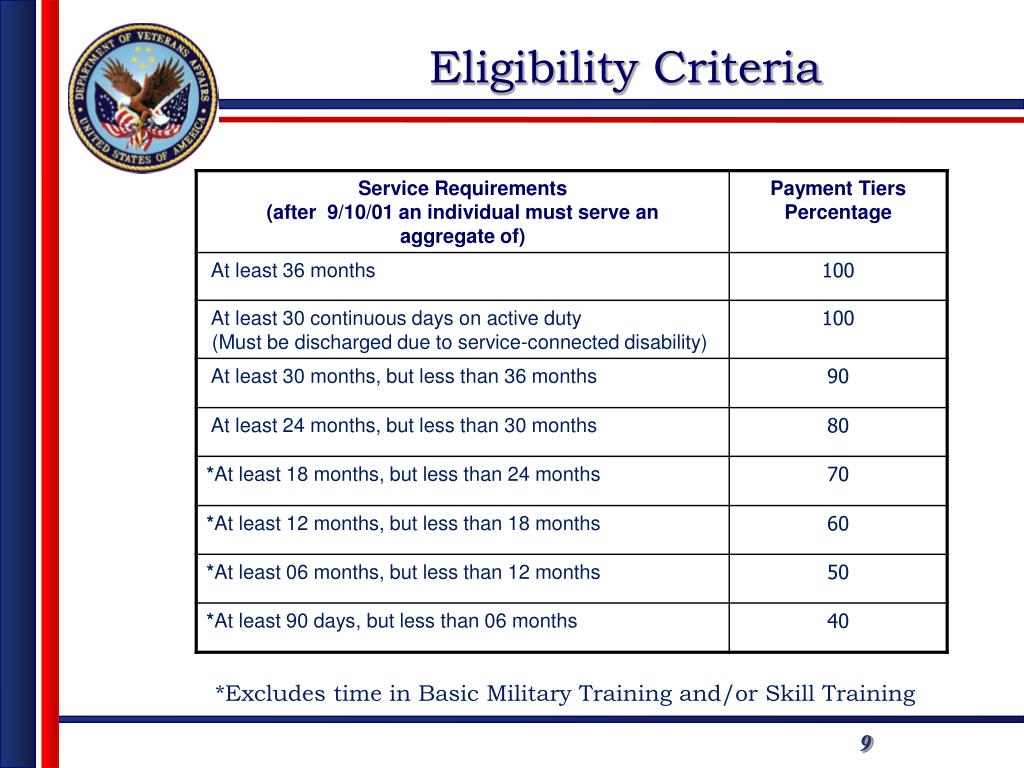

1. Review and Understand the Eligibility Criteria

To increase your chances of getting approved, it's crucial to review and understand the eligibility criteria set by Paumanack Village Greenlawn. This includes:

- Age restrictions

- Income requirements

- Credit score minimums

- Rental or purchase agreement terms

Make sure you meet all the requirements before submitting your application. If you're unsure about any of the criteria, don't hesitate to reach out to the Paumanack Village Greenlawn administration for clarification.

2. Prepare Your Financial Documents

Your financial documents are a critical part of the application process. Make sure you have all the necessary documents ready, including:

- Proof of income

- Bank statements

- Credit reports

- Rental or purchase agreement

Organize your documents in a clear and concise manner, and ensure they are up-to-date and accurate. This will help the Paumanack Village Greenlawn administration to quickly review your application and make a decision.

3. Showcase Your Rental or Purchase Agreement

Your rental or purchase agreement is a vital part of the application process. Make sure you have a clear and comprehensive agreement that outlines the terms and conditions of your tenancy or ownership.

Review your agreement carefully and ensure it meets all the requirements set by Paumanack Village Greenlawn. If you're unsure about any aspect of the agreement, don't hesitate to seek advice from a real estate agent or lawyer.

4. Demonstrate Your Creditworthiness

Your credit score plays a significant role in the application process. Make sure you have a good credit history by:

- Paying your bills on time

- Keeping your credit utilization ratio low

- Avoiding unnecessary credit inquiries

A good credit score will demonstrate your creditworthiness and increase your chances of getting approved.

5. Follow Up with the Administration

Once you've submitted your application, follow up with the Paumanack Village Greenlawn administration to ensure everything is in order. This includes:

- Confirming receipt of your application

- Providing additional documentation if required

- Answering any questions or concerns the administration may have

By following up with the administration, you can ensure your application is processed quickly and efficiently.

Gallery of Paumanack Village Greenlawn

FAQs

What is the eligibility criteria for Paumanack Village Greenlawn?

+The eligibility criteria for Paumanack Village Greenlawn includes age restrictions, income requirements, credit score minimums, and rental or purchase agreement terms.

What documents do I need to submit with my application?

+You will need to submit proof of income, bank statements, credit reports, and rental or purchase agreement.

How long does the application process take?

+The application process typically takes several weeks to several months, depending on the complexity of the application and the speed of the administration.

By following these 5 ways to ace your Paumanack Village Greenlawn application, you can increase your chances of getting approved and enjoying the beautiful community and amenities that Paumanack Village Greenlawn has to offer. Remember to review and understand the eligibility criteria, prepare your financial documents, showcase your rental or purchase agreement, demonstrate your creditworthiness, and follow up with the administration. Good luck with your application!