Filling out a loan application form can be a daunting task, especially for employees who may not be familiar with the process. However, with the right guidance, it can be a straightforward and stress-free experience. In this article, we will provide 5 ways to fill out a loan application form for employees, along with some valuable tips and tricks to help you navigate the process.

Why is it Important to Fill Out a Loan Application Form Correctly?

Before we dive into the nitty-gritty of filling out a loan application form, it's essential to understand why it's crucial to do it correctly. A loan application form is a critical document that lenders use to assess your creditworthiness and determine whether to approve your loan application. If you fill out the form incorrectly or omit important information, it can lead to delays, rejections, or even worse, a lower credit score.

5 Ways to Fill Out a Loan Application Form for Employees

1. Gather All Required Documents

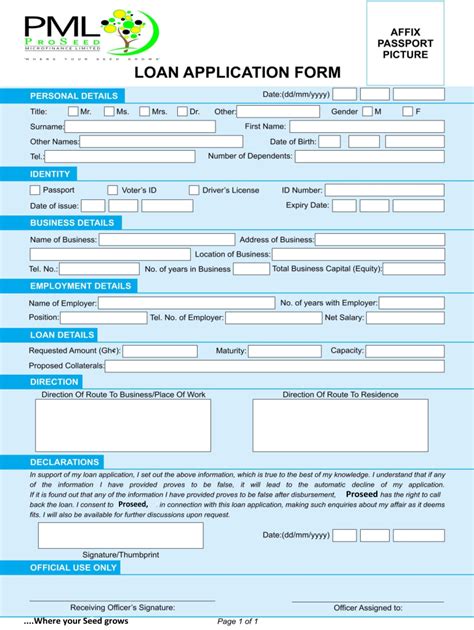

Before you start filling out the loan application form, make sure you have all the necessary documents and information ready. This may include:

- Identification documents (e.g., driver's license, passport)

- Proof of income (e.g., pay stubs, W-2 forms)

- Proof of employment (e.g., letter from employer, business card)

- Bank statements

- Credit reports (if applicable)

Having all the required documents and information at your fingertips will save you time and reduce the risk of errors.

2. Read the Form Carefully

Take the time to read the loan application form carefully, and make sure you understand what each section is asking for. Don't be afraid to ask for clarification if you're unsure about something. It's better to take your time and get it right than to rush through the form and risk making mistakes.

3. Fill Out the Form Accurately and Completely

When filling out the loan application form, make sure to provide accurate and complete information. Double-check your answers to ensure they are correct, and don't leave any sections blank unless it's specifically indicated that it's optional.

Tips:

- Use a black pen to fill out the form, and make sure your handwriting is legible.

- If you're filling out the form online, make sure to save your progress regularly to avoid losing your work.

- Don't hesitate to contact the lender if you have any questions or concerns.

4. Provide Detailed Financial Information

The loan application form will require you to provide detailed financial information, including your income, expenses, assets, and debts. Make sure to provide accurate and up-to-date information, and be prepared to explain any large purchases or transactions.

Example:

- If you've recently purchased a new car, be prepared to explain the loan terms and how you plan to make the payments.

- If you have any outstanding debts, be prepared to explain the amount, interest rate, and repayment terms.

5. Review and Edit the Form

Before submitting the loan application form, review it carefully to ensure everything is accurate and complete. Check for any spelling or grammatical errors, and make sure you've signed the form in the correct places.

Tips:

- Have a friend or family member review the form with you to catch any mistakes.

- Use a checklist to ensure you've completed all the required sections.

- Keep a copy of the form for your records.

Final Thoughts

Filling out a loan application form can be a daunting task, but by following these 5 ways, you can ensure that you do it correctly and increase your chances of getting approved. Remember to take your time, provide accurate and complete information, and review the form carefully before submitting it. Good luck!