Finding the perfect rental property can be a thrilling experience, but it can quickly turn into a disappointment if your rental application is denied. A denial can be frustrating, especially if you've already envisioned yourself living in the property. However, it's essential to remember that a denied application is not the end of the world. In fact, it can be an opportunity to learn and improve for future applications.

If your rental application has been denied, there are several steps you can take to understand the reason behind the denial and potentially overturn the decision. In this article, we'll outline the 5 steps to take if your rental application is denied.

Step 1: Understand the Reason for Denial

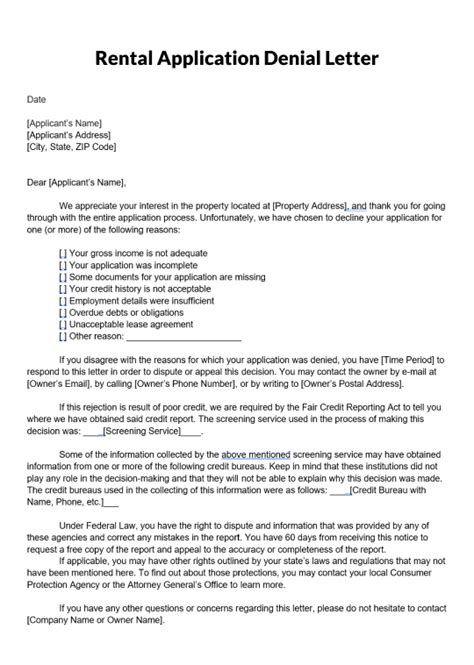

The first step to take if your rental application is denied is to understand the reason behind the denial. The landlord or property manager is required to provide you with a written explanation of the reason for denial. This explanation can help you identify areas for improvement and potentially address any issues that led to the denial.

Some common reasons for rental application denial include:

- Poor credit history

- Insufficient income

- Negative rental history

- Incomplete or inaccurate application

- Excessive debt

What to Do If You Don't Receive a Reason for Denial

If you don't receive a reason for denial, you can send a polite and professional email to the landlord or property manager requesting an explanation. This email should include your application number, the date you submitted your application, and a clear request for the reason behind the denial.

Example Email:

"Dear [Landlord/Property Manager],

I am writing to request an explanation for the denial of my rental application. I submitted my application on [date] and was informed that it was denied, but I did not receive a reason for the denial. Could you please provide me with a written explanation of the reason behind the denial?

Thank you for your time and assistance.

Sincerely, [Your Name]"

Step 2: Review and Address Any Issues

Once you understand the reason for denial, you can review and address any issues that led to the denial. This may involve:

- Checking your credit report for errors and disputing any inaccuracies

- Providing additional documentation to support your income or employment

- Addressing any negative rental history by providing a written explanation or proof of remediation

- Completing any missing or incomplete application sections

How to Dispute Errors on Your Credit Report

If you find errors on your credit report, you can dispute them with the credit reporting agency. This can help improve your credit score and increase your chances of approval for future rental applications.

To dispute errors on your credit report, follow these steps:

- Obtain a copy of your credit report from the credit reporting agency

- Identify the errors on your credit report

- Gather documentation to support your dispute

- Submit your dispute to the credit reporting agency

Step 3: Provide Additional Documentation

If the landlord or property manager is willing to reconsider your application, you can provide additional documentation to support your income, employment, or rental history. This may include:

- Pay stubs or W-2 forms to demonstrate income

- Letters of employment or verification of income

- Rental references or proof of timely rent payments

- Bank statements or proof of savings

How to Obtain a Letter of Employment

A letter of employment can be a valuable document to support your rental application. To obtain a letter of employment, follow these steps:

- Request a letter from your employer or HR department

- Provide your employer with the necessary information, such as your job title, dates of employment, and salary

- Ensure the letter is written on company letterhead and signed by your employer or HR representative

Step 4: Negotiate with the Landlord or Property Manager

If you've addressed any issues and provided additional documentation, you can negotiate with the landlord or property manager to reconsider your application. This may involve:

- Offering to pay a higher security deposit

- Agreeing to a shorter lease term

- Providing additional references or documentation

How to Negotiate a Higher Security Deposit

If you're willing to pay a higher security deposit, you can negotiate with the landlord or property manager to reconsider your application. To negotiate a higher security deposit, follow these steps:

- Research the market rate for security deposits in your area

- Calculate the amount you're willing to pay

- Make a written offer to the landlord or property manager, including the amount you're willing to pay and any other terms or conditions

Step 5: Consider Alternative Options

If your rental application is denied and you're unable to negotiate with the landlord or property manager, it's time to consider alternative options. This may involve:

- Applying for a different rental property

- Working with a co-signer or guarantor

- Considering a shorter lease term or alternative lease options

How to Find Alternative Rental Properties

If you're unable to secure the rental property you want, it's time to start searching for alternative options. To find alternative rental properties, follow these steps:

- Research online listings and rental websites

- Network with friends, family, and colleagues to find rental leads

- Work with a real estate agent or property manager to find alternative properties

We hope this article has provided you with valuable insights and steps to take if your rental application is denied. Remember to stay positive and persistent, and don't be afraid to negotiate or consider alternative options. Good luck!

What are the most common reasons for rental application denial?

+The most common reasons for rental application denial include poor credit history, insufficient income, negative rental history, incomplete or inaccurate application, and excessive debt.

How can I dispute errors on my credit report?

+To dispute errors on your credit report, obtain a copy of your credit report, identify the errors, gather documentation to support your dispute, and submit your dispute to the credit reporting agency.

What are some alternative options if my rental application is denied?

+Alternative options may include applying for a different rental property, working with a co-signer or guarantor, or considering a shorter lease term or alternative lease options.