As the housing market continues to grow in Utah, finding the perfect rental property can be a challenging and competitive process. With numerous applicants vying for a limited number of rentals, it's essential to ensure that your rental application stands out from the rest. In this article, we'll provide you with 5 valuable tips to help you successfully navigate the rental application process in Utah.

Utah's rental market is booming, with many renters searching for the perfect place to call home. However, with so many applicants competing for a limited number of rentals, it's crucial to be prepared and to have a solid understanding of the rental application process.

To increase your chances of securing your desired rental property, it's essential to be proactive and to take the necessary steps to ensure that your rental application is complete, accurate, and compelling.

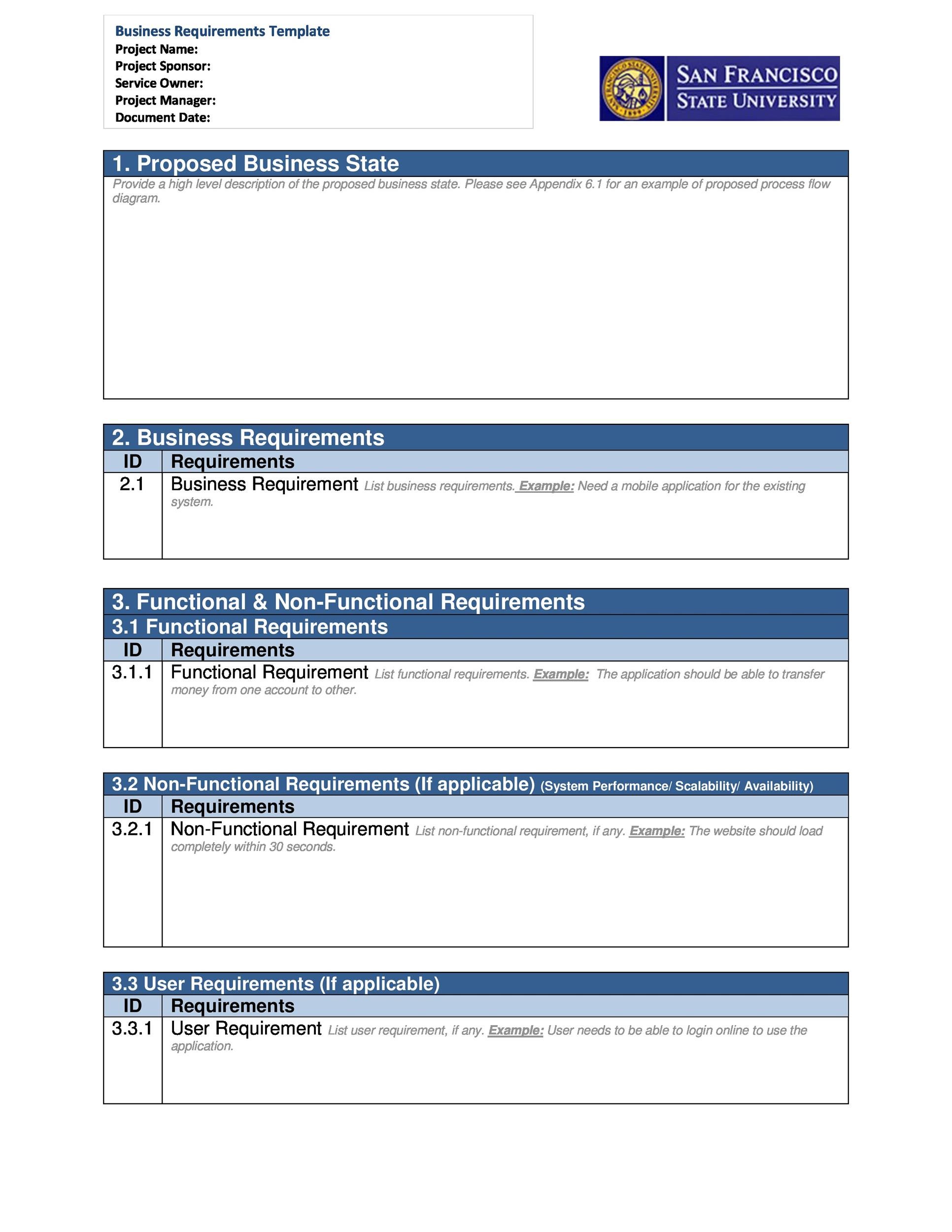

Tip 1: Understand the Rental Application Process

Before you begin the rental application process, it's essential to understand what to expect. In Utah, the rental application process typically involves the following steps:

- Submitting a rental application form

- Providing proof of income and employment

- Offering rental history and references

- Paying an application fee

- Signing a lease agreement

By understanding the rental application process, you can better prepare yourself and ensure that your application is complete and accurate.

Tip 2: Gather Required Documents

To ensure that your rental application is complete and accurate, it's essential to gather all required documents beforehand. These documents may include:

- Proof of income and employment

- Rental history and references

- Identification and credit reports

- Proof of insurance

By gathering all required documents beforehand, you can ensure that your rental application is complete and accurate, and that you can avoid any delays or setbacks.

Tip 3: Be Prepared to Pay an Application Fee

In Utah, it's common for landlords and property managers to charge an application fee. This fee can range from $20 to $100, depending on the landlord or property manager.

By being prepared to pay an application fee, you can ensure that your rental application is processed quickly and efficiently.

Tip 4: Be Honest and Transparent

When filling out your rental application, it's essential to be honest and transparent. This includes providing accurate information about your income, employment, and rental history.

By being honest and transparent, you can build trust with your landlord or property manager, and increase your chances of securing your desired rental property.

Tip 5: Follow Up

After submitting your rental application, it's essential to follow up with your landlord or property manager. This can help ensure that your application is processed quickly and efficiently, and that you can avoid any delays or setbacks.

By following up, you can demonstrate your interest in the rental property, and increase your chances of securing your desired rental property.

By following these 5 valuable tips, you can increase your chances of securing your desired rental property in Utah. Remember to understand the rental application process, gather required documents, be prepared to pay an application fee, be honest and transparent, and follow up with your landlord or property manager.

Don't forget to share your experiences and tips for a successful rental application in the comments below!

What is the average rent in Utah?

+The average rent in Utah varies depending on the location and type of property. However, according to recent data, the average rent for a one-bedroom apartment in Utah is around $1,000 per month.

How long does the rental application process typically take?

+The rental application process typically takes around 1-3 business days, depending on the landlord or property manager. However, this timeframe can vary depending on the complexity of the application and the speed of the landlord or property manager.

What is the most important factor in a rental application?

+The most important factor in a rental application is typically the applicant's credit score and rental history. A good credit score and positive rental history can increase an applicant's chances of securing a rental property.