The process of renting a property can be an exciting yet nerve-wracking experience. As a potential tenant, you may have spent hours searching for the perfect place, only to have your rental application rejected. If you're wondering why this might have happened, you're not alone. In this article, we'll explore five common reasons why rental applications get rejected, and what you can do to improve your chances of approval.

Reason 1: Poor Credit History

Your credit score plays a significant role in determining whether you're a reliable tenant. A poor credit history can raise concerns for landlords, as it may indicate that you're not responsible with finances. Late payments, collections, and bankruptcies can all negatively impact your credit score.

To improve your chances of approval, focus on rebuilding your credit score. Make timely payments, pay off outstanding debts, and monitor your credit report for errors. You can also consider providing additional financial documentation, such as proof of income or employment, to demonstrate your ability to pay rent.

Understanding Credit Scores

Credit scores range from 300 to 850, with higher scores indicating better credit. In general, a credit score of 700 or higher is considered good. However, some landlords may have stricter requirements, so it's essential to know your credit score and be prepared to discuss it.

Reason 2: Insufficient Income

Landlords want to ensure that you can afford the rent. If your income is insufficient, they may reject your application. Typically, landlords require tenants to earn at least three times the monthly rent. For example, if the rent is $1,500, you should earn at least $4,500 per month.

To overcome this obstacle, consider providing additional financial documentation, such as proof of bonuses, commissions, or other sources of income. You can also explore co-signing options or finding a roommate to split the rent.

Calculating Income Requirements

To determine whether you meet the income requirements, calculate your gross income (before taxes) and multiply it by 0.3. This will give you the minimum monthly rent you can afford. For example, if your gross income is $4,000, you can afford up to $1,200 in monthly rent.

Reason 3: Employment History

A stable employment history is essential for securing a rental property. If you have gaps in employment or a history of job-hopping, landlords may view you as a high-risk tenant.

To address this concern, provide detailed explanations for any employment gaps or job changes. You can also offer letters of recommendation from previous employers or provide proof of steady income.

Understanding Employment Requirements

Typically, landlords require tenants to have a minimum of six months to one year of stable employment. However, this requirement may vary depending on the landlord or property manager.

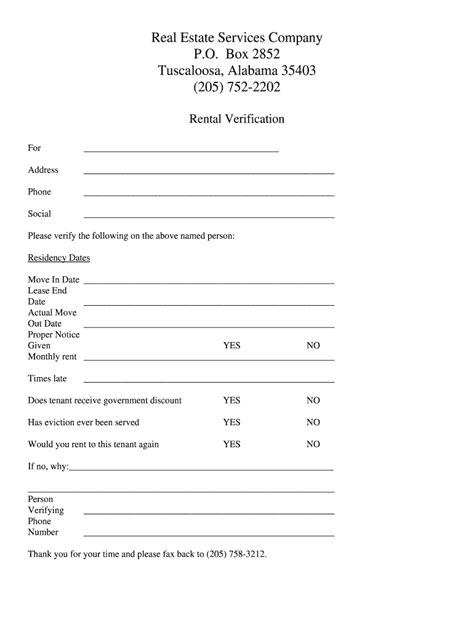

Reason 4: Rental History

Your rental history can make or break your application. If you have a history of late payments, property damage, or evictions, landlords may reject your application.

To overcome this obstacle, provide detailed explanations for any issues in your rental history. You can also offer letters of recommendation from previous landlords or provide proof of timely payments.

Understanding Rental History Requirements

Typically, landlords require tenants to have a minimum of two to three years of positive rental history. However, this requirement may vary depending on the landlord or property manager.

Reason 5: Incomplete or Inaccurate Application

A poorly completed or inaccurate application can lead to rejection. Make sure to provide all required documentation and double-check your application for errors.

To avoid this mistake, take your time when completing the application, and ensure that all information is accurate and up-to-date. You can also consider having a friend or family member review your application before submitting it.

Understanding Application Requirements

Typically, rental applications require documentation such as proof of income, employment, and rental history. Be sure to review the application carefully and provide all required documentation.

What is the typical credit score requirement for rental applications?

+Typically, landlords require a credit score of 700 or higher. However, this requirement may vary depending on the landlord or property manager.

How can I improve my chances of approval if I have a poor credit history?

+To improve your chances of approval, focus on rebuilding your credit score. Make timely payments, pay off outstanding debts, and monitor your credit report for errors. You can also consider providing additional financial documentation, such as proof of income or employment, to demonstrate your ability to pay rent.

What is the typical income requirement for rental applications?

+Typically, landlords require tenants to earn at least three times the monthly rent. However, this requirement may vary depending on the landlord or property manager.

In conclusion, understanding the common reasons for rental application rejection can help you prepare and improve your chances of approval. By addressing concerns such as poor credit history, insufficient income, employment history, rental history, and incomplete or inaccurate applications, you can increase your chances of securing your dream rental property.