Being denied for a rental application can be frustrating and disappointing, especially if you have your heart set on a particular property. However, it's essential to understand that a denial doesn't necessarily mean you're not a qualified tenant. There could be various reasons behind the denial, and it's crucial to know what to do next.

Firstly, it's vital to ask for a reason behind the denial. Under the Fair Credit Reporting Act (FCRA), landlords are required to provide a written notice explaining the reason for the denial if it's based on information obtained from a consumer reporting agency. This notice should include the name and address of the agency, as well as a statement indicating that you have the right to dispute the accuracy of the information.

Understanding the Denial Reason

There could be several reasons why your rental application was denied. Some common reasons include:

- Poor credit history: A low credit score or a history of late payments can raise concerns for landlords.

- Insufficient income: If your income is not sufficient to cover the rent, utilities, and other expenses, the landlord may deny your application.

- Rental history: A history of evictions, late payments, or property damage can make it challenging to secure a rental property.

- Employment status: If you're self-employed or have a non-traditional employment arrangement, the landlord may require additional documentation or verification.

What to Do Next

If you've been denied for a rental application, there are several steps you can take:

- Request a copy of your credit report: If the denial was based on information obtained from a consumer reporting agency, you can request a free copy of your credit report from the agency. Review the report carefully and dispute any errors or inaccuracies.

- Provide additional documentation: If the landlord requires additional documentation or verification, be prepared to provide it. This could include proof of income, employment verification, or rental history.

- Look for alternative properties: If you're unable to secure the property you initially applied for, consider looking for alternative properties that may have more lenient qualification standards.

- Work on improving your credit score: If your credit score is the reason for the denial, focus on improving it. Pay your bills on time, reduce your debt, and avoid applying for multiple credit cards or loans.

Appealing the Denial

If you believe the denial was unfair or based on incorrect information, you can appeal the decision. Here are some steps to follow:

- Review the denial notice: Carefully review the denial notice to understand the reason behind the denial.

- Gather supporting documentation: Collect any supporting documentation that can help prove your case. This could include proof of income, employment verification, or rental history.

- Submit an appeal: Submit an appeal to the landlord or property manager, providing any supporting documentation and explaining why you believe the denial was unfair.

Preventing Future Denials

To avoid future denials, it's essential to understand what landlords look for in a rental application. Here are some tips to increase your chances of approval:

- Check your credit report: Before applying for a rental property, check your credit report to ensure it's accurate and up-to-date.

- Provide complete documentation: Make sure to provide complete and accurate documentation, including proof of income, employment verification, and rental history.

- Be honest: Be honest and transparent about your credit history, employment status, and rental history.

- Work on improving your credit score: If you have a poor credit score, focus on improving it by paying your bills on time, reducing your debt, and avoiding applying for multiple credit cards or loans.

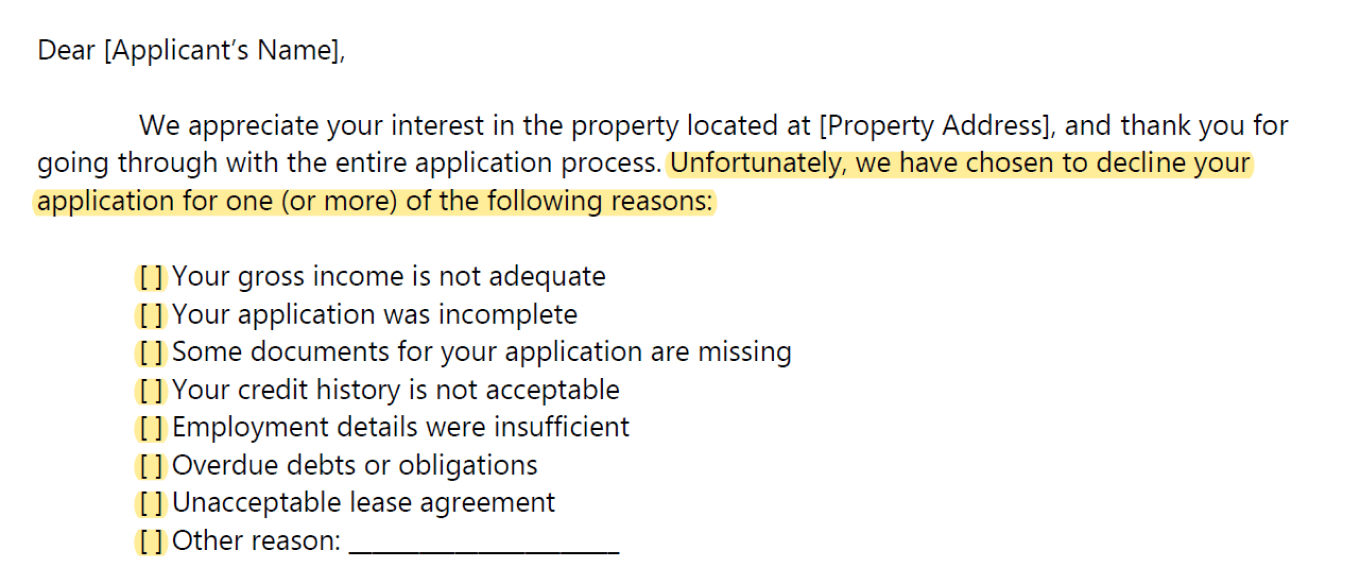

Rental Application Denial Letter Sample

Here's a sample rental application denial letter:

[Landlord's Name] [Landlord's Address] [City, State, ZIP] [Date]

[Applicant's Name] [Applicant's Address] [City, State, ZIP]

Dear [Applicant's Name],

Re: Rental Application for [Property Address]

Thank you for your interest in renting [Property Address]. We appreciate the time you took to complete our rental application.

After careful review of your application, we regret to inform you that we are unable to approve your application at this time. The reason for this denial is [insert reason, e.g., poor credit history, insufficient income, etc.].

Please note that this decision was made based on information obtained from [consumer reporting agency]. You have the right to dispute the accuracy of this information and obtain a free copy of your credit report from the agency.

If you have any questions or concerns, please do not hesitate to contact us.

Sincerely,

[Landlord's Name]

Gallery of Rental Application Denial

What is a rental application denial letter?

+A rental application denial letter is a formal letter sent by a landlord or property manager to an applicant, informing them that their rental application has been denied.

What are the common reasons for rental application denial?

+Common reasons for rental application denial include poor credit history, insufficient income, rental history, and employment status.

How can I appeal a rental application denial?

+To appeal a rental application denial, review the denial notice, gather supporting documentation, and submit an appeal to the landlord or property manager.