If you're a homeowner in Manatee County, Florida, you're likely aware of the importance of filing for homestead exemption. This exemption can provide significant tax savings and protect your primary residence from creditors. However, navigating the application process can be daunting, especially for first-time filers. In this article, we'll break down the Manatee County homestead application process, making it easier for you to understand and complete.

The Benefits of Homestead Exemption

Before we dive into the application process, it's essential to understand the benefits of homestead exemption. By filing for homestead exemption, you can:

- Reduce your property taxes: Homestead exemption can exempt up to $50,000 of your primary residence's value from property taxes.

- Protect your home from creditors: Homestead exemption can protect your primary residence from creditors, ensuring that you and your family have a safe place to live.

Eligibility Requirements

To be eligible for homestead exemption in Manatee County, you must meet the following requirements:

- You must be a Florida resident

- You must own the property and occupy it as your primary residence

- You must have a valid social security number or Individual Taxpayer Identification Number (ITIN)

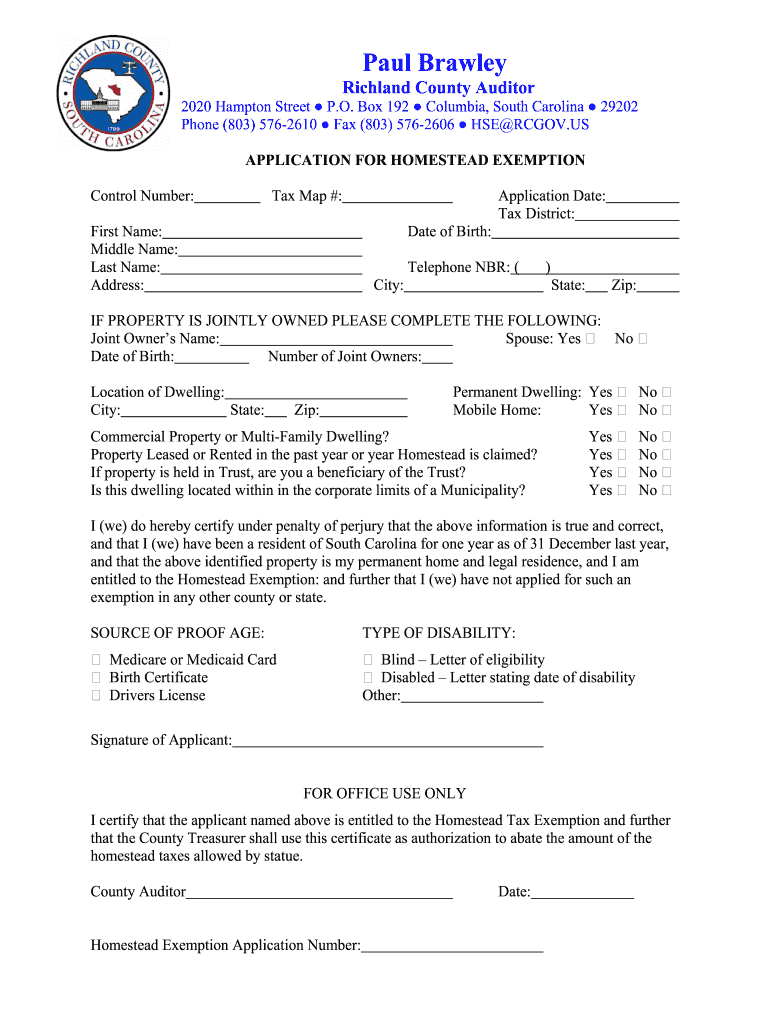

Gathering Required Documents

Before starting the application process, you'll need to gather the required documents. These include:

- Proof of Florida residency (e.g., driver's license, state ID, or voter registration card)

- Proof of property ownership (e.g., deed or title)

- Proof of social security number or ITIN

- A copy of your property tax bill

Application Process

Now that you've gathered the required documents, it's time to start the application process. You can file for homestead exemption in person, by mail, or online.

In-Person Application

To file in person, visit the Manatee County Property Appraiser's office located at 915 4th Ave W, Bradenton, FL 34205. Bring the required documents and a completed application form (available on the Property Appraiser's website).

Mail Application

To file by mail, send the completed application form and required documents to:

Manatee County Property Appraiser 915 4th Ave W Bradenton, FL 34205

Online Application

To file online, visit the Manatee County Property Appraiser's website and follow the online application instructions.

Timeline and Deadlines

The deadline to file for homestead exemption in Manatee County is March 1st of each year. However, it's essential to note that you can file for exemption at any time, and the exemption will be applied to the following tax year.

Key Dates

- January 1st: The start of the new tax year

- March 1st: The deadline to file for homestead exemption

- November 1st: The start of the tax billing cycle

Common Mistakes to Avoid

When filing for homestead exemption, it's essential to avoid common mistakes that can delay or deny your application. These include:

- Failing to provide required documents

- Filing after the deadline

- Filing for exemption on a property that is not your primary residence

Conclusion

Filing for homestead exemption in Manatee County can be a straightforward process if you're prepared. By gathering the required documents, understanding the eligibility requirements, and avoiding common mistakes, you can ensure a smooth application process. Remember to file before the March 1st deadline to take advantage of the exemption for the following tax year.

Gallery of Homestead Exemption Forms and Deadlines

FAQ Section

What is homestead exemption?

+Homestead exemption is a tax exemption that can exempt up to $50,000 of your primary residence's value from property taxes.

Who is eligible for homestead exemption?

+To be eligible for homestead exemption, you must be a Florida resident, own the property and occupy it as your primary residence, and have a valid social security number or ITIN.

What is the deadline to file for homestead exemption?

+The deadline to file for homestead exemption is March 1st of each year.