Are you in need of financial assistance to cover unexpected expenses or achieve your long-term goals? Little Wind Loans might be the solution you're looking for. As a responsible lender, they offer a straightforward and efficient loan application process. In this article, we'll guide you through the 5 simple steps to apply for Little Wind Loans, making it easier for you to access the funds you need.

Understanding Little Wind Loans

Before we dive into the application process, it's essential to understand what Little Wind Loans offers. They provide installment loans with flexible repayment terms, allowing you to borrow a lump sum of money and repay it in equal installments over a set period. This type of loan is ideal for those who need quick access to cash but want to avoid the high interest rates and fees associated with payday loans.

Step 1: Check Your Eligibility

To qualify for a Little Wind Loan, you must meet certain eligibility criteria. These typically include:

- Being at least 18 years old (or the age of majority in your state)

- Having a valid government-issued ID

- Providing proof of income

- Having an active checking account

- Not being currently bankrupt or in debt collections

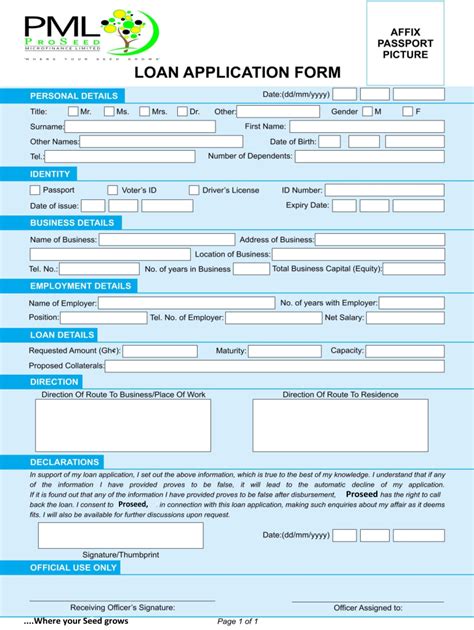

Step 2: Gather Required Documents

To complete the loan application process, you'll need to provide some essential documents. These may include:

- Identification documents (driver's license, passport, or state ID)

- Proof of income (pay stubs, W-2 forms, or tax returns)

- Bank account information (account number and routing number)

- Social Security number or Individual Taxpayer Identification Number (ITIN)

Make sure you have these documents readily available to avoid delays in the application process.

Step 3: Submit Your Application

Once you've gathered the required documents, you can submit your loan application. You can do this online, by phone, or in-person at a local branch (if available). The application process typically takes a few minutes to complete and will ask for the following information:

- Personal details (name, address, date of birth, etc.)

- Income and employment information

- Bank account details

- Loan amount and repayment term preferences

Step 4: Review and Sign Your Loan Agreement

After submitting your application, Little Wind Loans will review your information and determine whether you're eligible for a loan. If approved, they'll present you with a loan agreement outlining the terms and conditions of the loan. This document will include:

- Loan amount and interest rate

- Repayment term and schedule

- Fees and charges

- Prepayment penalties (if applicable)

Carefully review the loan agreement to ensure you understand the terms and conditions. If you're satisfied, sign and return the agreement to finalize the loan.

Step 5: Receive Your Funds

Once you've signed and returned the loan agreement, Little Wind Loans will disburse the funds into your bank account. This typically occurs within one business day, although the exact timeframe may vary depending on your bank's processing times.

Gallery of Loan-Related Images

Frequently Asked Questions

What is the interest rate on Little Wind Loans?

+The interest rate on Little Wind Loans varies depending on your credit score, loan amount, and repayment term.

How long does it take to receive the funds?

+Funds are typically disbursed within one business day after signing the loan agreement.

Can I prepay my loan without penalties?

+Yes, Little Wind Loans allows prepayment without penalties. However, please review your loan agreement for specific terms and conditions.

By following these 5 simple steps, you can apply for a Little Wind Loan and access the funds you need to achieve your financial goals. Remember to carefully review the loan agreement and understand the terms and conditions before signing. If you have any questions or concerns, don't hesitate to reach out to their customer support team.