The world of liquor liability insurance can be a complex and daunting one, especially for businesses that serve or sell alcohol. As a business owner, it's essential to understand the risks associated with serving liquor and the importance of having adequate insurance coverage. In this article, we'll provide a comprehensive guide to liquor liability supplemental applications for businesses, including the benefits, requirements, and process of obtaining coverage.

Why Do Businesses Need Liquor Liability Insurance?

Liquor liability insurance is a type of coverage that protects businesses from claims arising from the sale or service of alcohol. This type of insurance is essential for businesses that serve or sell liquor, as it can help mitigate the risks associated with intoxication, accidents, and injuries.

Without liquor liability insurance, businesses can be held liable for damages, injuries, or even fatalities that occur as a result of intoxication. This can lead to costly lawsuits, reputational damage, and even financial ruin.

Benefits of Liquor Liability Insurance

Liquor liability insurance provides several benefits to businesses, including:

- Protection from costly lawsuits and damages

- Coverage for medical expenses, lost wages, and other related costs

- Defense costs, including attorney fees and court expenses

- Business interruption coverage, which can help offset lost revenue

- Enhanced reputation and credibility

What is a Liquor Liability Supplemental Application?

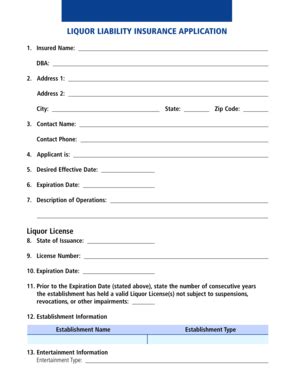

A liquor liability supplemental application is a document that businesses must complete to obtain liquor liability insurance coverage. The application provides additional information about the business, including its operations, risk management practices, and insurance history.

The supplemental application is used to assess the business's level of risk and determine the appropriate premium rates. It's typically used in conjunction with a standard business insurance application.

What Information is Required on a Liquor Liability Supplemental Application?

The liquor liability supplemental application will typically require businesses to provide the following information:

- Business operations, including the type of establishment, hours of operation, and number of employees

- Liquor sales data, including the percentage of sales, types of liquor sold, and average monthly sales

- Risk management practices, including staff training, ID verification, and crowd control measures

- Insurance history, including previous claims and policy cancellations

- Financial information, including annual revenue and net worth

How to Complete a Liquor Liability Supplemental Application

Completing a liquor liability supplemental application can be a straightforward process, but it's essential to provide accurate and detailed information. Here are some tips to help you complete the application:

- Review the application carefully and ensure you understand what information is required

- Provide detailed information about your business operations, including your risk management practices

- Be honest and transparent about your insurance history and previous claims

- Ensure you have all required documentation, including financial statements and liquor sales data

What to Expect After Submitting a Liquor Liability Supplemental Application

After submitting a liquor liability supplemental application, you can expect the following:

- The insurance company will review your application and assess your level of risk

- The insurance company may request additional information or documentation

- You will receive a quote for premium rates and coverage options

- You can choose to accept or decline the coverage offer

Tips for Getting the Best Liquor Liability Insurance Coverage

Here are some tips for getting the best liquor liability insurance coverage:

- Shop around and compare quotes from multiple insurance companies

- Consider working with an insurance broker or agent who specializes in liquor liability insurance

- Ensure you have adequate coverage limits and a comprehensive policy

- Review your policy regularly and update your coverage as needed

Common Mistakes to Avoid When Completing a Liquor Liability Supplemental Application

Here are some common mistakes to avoid when completing a liquor liability supplemental application:

- Providing inaccurate or incomplete information

- Failing to disclose previous claims or insurance history

- Not providing required documentation or financial statements

- Not reviewing the application carefully before submitting

Gallery of Liquor Liability Insurance

FAQs

What is liquor liability insurance?

+Liquor liability insurance is a type of coverage that protects businesses from claims arising from the sale or service of alcohol.

Why do businesses need liquor liability insurance?

+Businesses need liquor liability insurance to protect themselves from costly lawsuits and damages arising from intoxication, accidents, and injuries.

What information is required on a liquor liability supplemental application?

+The liquor liability supplemental application will typically require businesses to provide information about their operations, risk management practices, insurance history, and financial information.

We hope this guide has provided you with a comprehensive understanding of liquor liability supplemental applications for businesses. Remember to shop around, compare quotes, and ensure you have adequate coverage limits and a comprehensive policy.