When you apply for a loan or credit, lenders evaluate your creditworthiness to determine the likelihood of repaying the borrowed amount. This process involves assessing various factors that contribute to your credit profile. Understanding what lenders consider during this evaluation can help you prepare and potentially improve your chances of getting approved for a loan.

What Do Lenders Consider When Evaluating Your Credit Application?

Lenders typically consider a combination of the following factors when evaluating your credit application:

1. Credit Score

Your credit score is a three-digit number that represents your credit history and repayment behavior. It's calculated based on information in your credit reports, such as payment history, credit utilization, and credit age. Lenders use credit scores to quickly assess your creditworthiness and determine the interest rate you'll qualify for.

2. Credit History

Your credit history provides a detailed account of your past credit activities, including payments, credit inquiries, and public records. Lenders review your credit history to identify any negative marks, such as late payments, collections, or bankruptcies, which can impact your credit score.

3. Income and Employment

Lenders want to ensure you have a stable income and employment history to repay the loan. They may request proof of income, such as pay stubs or tax returns, and verify your employment status.

4. Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is the percentage of your monthly gross income that goes towards paying debts, including the loan you're applying for. Lenders use this ratio to determine whether you can afford the loan payments.

5. Credit Utilization

Credit utilization refers to the amount of credit you're using compared to the credit available to you. Lenders prefer borrowers with low credit utilization ratios, as it indicates responsible credit behavior.

6. Loan Amount and Term

The loan amount and term you're applying for can impact the lender's decision. Lenders may offer more favorable terms for smaller loan amounts or shorter loan terms.

7. Collateral (if applicable)

If you're applying for a secured loan, such as a mortgage or car loan, the lender will consider the value of the collateral. The collateral serves as security for the loan, and the lender can seize it if you default on payments.

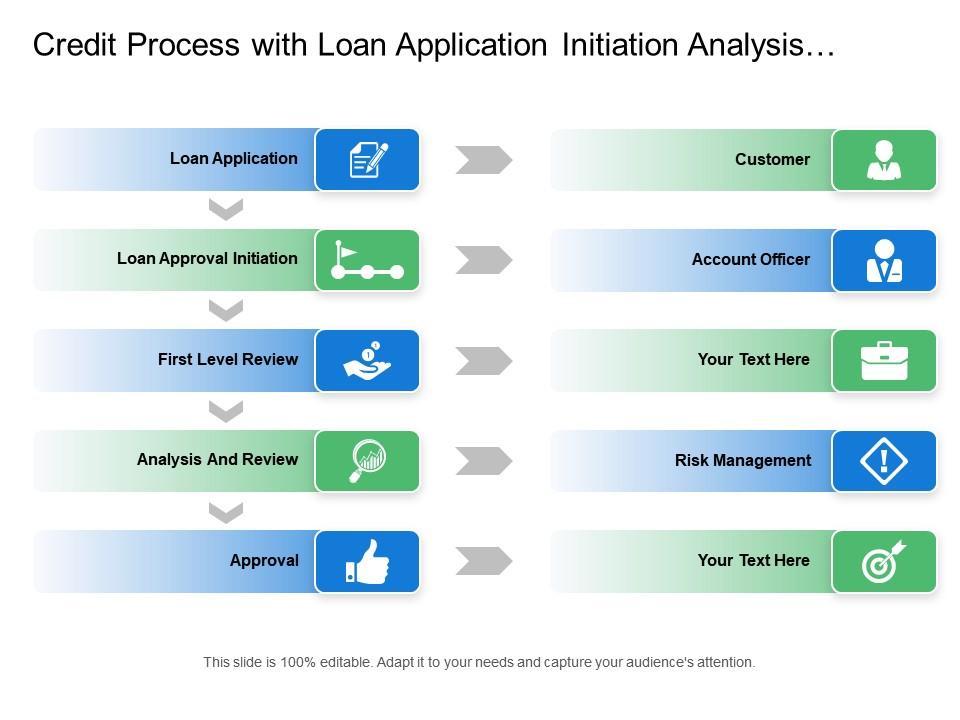

How Lenders Evaluate Your Credit Application

When evaluating your credit application, lenders typically follow a step-by-step process:

1. Initial Review

The lender reviews your credit application to ensure you meet the minimum requirements, such as age, income, and employment.

2. Credit Report Review

The lender obtains your credit reports from the three major credit bureaus (Experian, TransUnion, and Equifax) and reviews them for any negative marks or red flags.

3. Credit Score Analysis

The lender analyzes your credit score to determine your creditworthiness and interest rate eligibility.

4. Income and Employment Verification

The lender verifies your income and employment status to ensure you can afford the loan payments.

5. Debt-to-Income Ratio Calculation

The lender calculates your DTI ratio to determine whether you can afford the loan payments.

6. Loan Term and Amount Evaluation

The lender evaluates the loan amount and term you're applying for to determine the risk level.

7. Final Decision

The lender makes a final decision based on the evaluation results, and you'll receive a loan offer or rejection.

What Can You Do to Improve Your Chances of Getting Approved?

To improve your chances of getting approved for a loan, consider the following:

1. Check Your Credit Report

Review your credit report for errors or inaccuracies and dispute them if necessary.

2. Improve Your Credit Score

Work on improving your credit score by making on-time payments, reducing debt, and avoiding new credit inquiries.

3. Reduce Debt

Reduce your debt levels to improve your DTI ratio and demonstrate responsible credit behavior.

4. Increase Income

Consider increasing your income to improve your ability to repay the loan.

5. Choose the Right Loan

Choose a loan that aligns with your credit profile and financial situation.

Gallery of Credit Application Images

What is the minimum credit score required for a loan?

+The minimum credit score required for a loan varies depending on the lender and loan type. Generally, a credit score of 600 or higher is considered good.

How long does it take to process a loan application?

+The loan application process typically takes a few days to a few weeks, depending on the lender and the complexity of the application.

Can I get a loan with a bad credit score?

+Yes, it is possible to get a loan with a bad credit score, but you may face higher interest rates or stricter loan terms.

By understanding what lenders consider when evaluating your credit application, you can take steps to improve your chances of getting approved for a loan. Remember to check your credit report, improve your credit score, reduce debt, increase income, and choose the right loan for your needs.