As a landlord, rejecting a tenant application is never easy. However, it's a crucial step in ensuring that you find the right tenant for your rental property. The key is to do it in a fair and respectful manner, while also protecting yourself from potential liabilities. In this article, we'll explore seven ways to reject a tenant application, along with some practical tips and guidelines to help you navigate this process.

Why Reject a Tenant Application?

Before we dive into the ways to reject a tenant application, it's essential to understand why you might need to do so in the first place. Here are a few reasons:

- Poor credit history or insufficient income

- Inadequate rental history or evictions

- Incomplete or inaccurate application

- Unsatisfactory references or background checks

- Failure to meet pet or smoking policies

- Inability to pay rent or security deposit

1. Low Credit Score

A low credit score is often a major red flag for landlords. If a tenant's credit score is below a certain threshold (e.g., 600), you may want to consider rejecting their application. However, be sure to follow the Fair Credit Reporting Act (FCRA) guidelines and provide the tenant with a copy of their credit report.

2. Insufficient Income

If a tenant's income is insufficient to cover the rent, you may want to reject their application. Be sure to consider factors like income verification, debt-to-income ratio, and employment history.

3. Inadequate Rental History

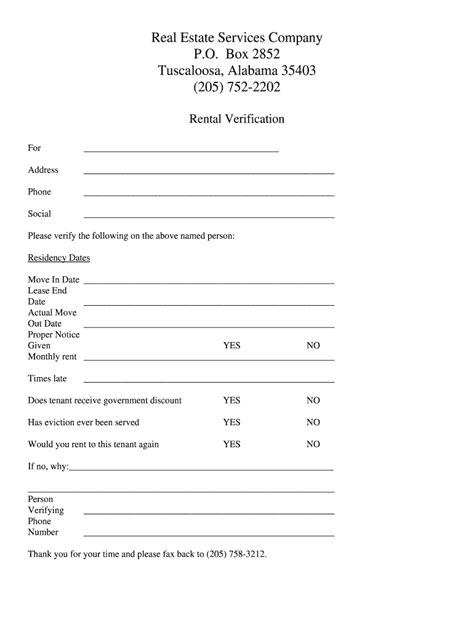

A tenant's rental history can be a significant indicator of their reliability and responsibility. If a tenant has a history of evictions, late payments, or property damage, you may want to consider rejecting their application.

4. Incomplete or Inaccurate Application

If a tenant's application is incomplete or contains inaccuracies, you may want to reject it. Be sure to provide the tenant with a clear explanation of what information is missing or incorrect.

5. Unsatisfactory References or Background Checks

If a tenant's references or background checks raise concerns, you may want to reject their application. Be sure to follow the Fair Credit Reporting Act (FCRA) guidelines and provide the tenant with a copy of their background check report.

6. Failure to Meet Pet or Smoking Policies

If a tenant fails to meet your pet or smoking policies, you may want to reject their application. Be sure to clearly communicate your policies and provide a clear explanation for the rejection.

7. Inability to Pay Rent or Security Deposit

If a tenant is unable to pay the rent or security deposit, you may want to reject their application. Be sure to consider factors like income verification and debt-to-income ratio.

Gallery of Tenant Screening

Frequently Asked Questions

What is the Fair Credit Reporting Act (FCRA)?

+The Fair Credit Reporting Act (FCRA) is a federal law that regulates the use of consumer credit reports.

How do I verify a tenant's income?

+You can verify a tenant's income by requesting pay stubs, W-2 forms, or tax returns.

What is a debt-to-income ratio?

+A debt-to-income ratio is a calculation that compares a tenant's monthly debt payments to their monthly income.

Remember, rejecting a tenant application is never easy, but it's a crucial step in ensuring that you find the right tenant for your rental property. By following these seven ways to reject a tenant application, you can protect yourself from potential liabilities and find a reliable tenant.