In today's economy, having a good credit score is crucial for securing loans, credit cards, and other forms of credit. A successful consumer credit application can open doors to new financial opportunities, while a rejected application can leave you feeling frustrated and uncertain about your financial future. In this article, we will guide you through the six steps to a successful consumer credit application.

Applying for credit can be a daunting task, especially for those who are new to the world of credit or have experienced financial setbacks in the past. With the rise of online lending and the increasing complexity of credit applications, it's easy to feel overwhelmed. However, by understanding the process and taking the right steps, you can increase your chances of approval and set yourself up for long-term financial success.

Step 1: Check Your Credit Report Before applying for credit, it's essential to check your credit report. Your credit report contains information about your credit history, including your payment history, credit utilization, and any past credit inquiries. You can request a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year from AnnualCreditReport.com.

Review your credit report carefully, looking for any errors or inaccuracies. If you find any mistakes, dispute them with the credit reporting agency and work to resolve the issue. A good credit score can significantly improve your chances of approval, so it's crucial to ensure your credit report is accurate and up-to-date.

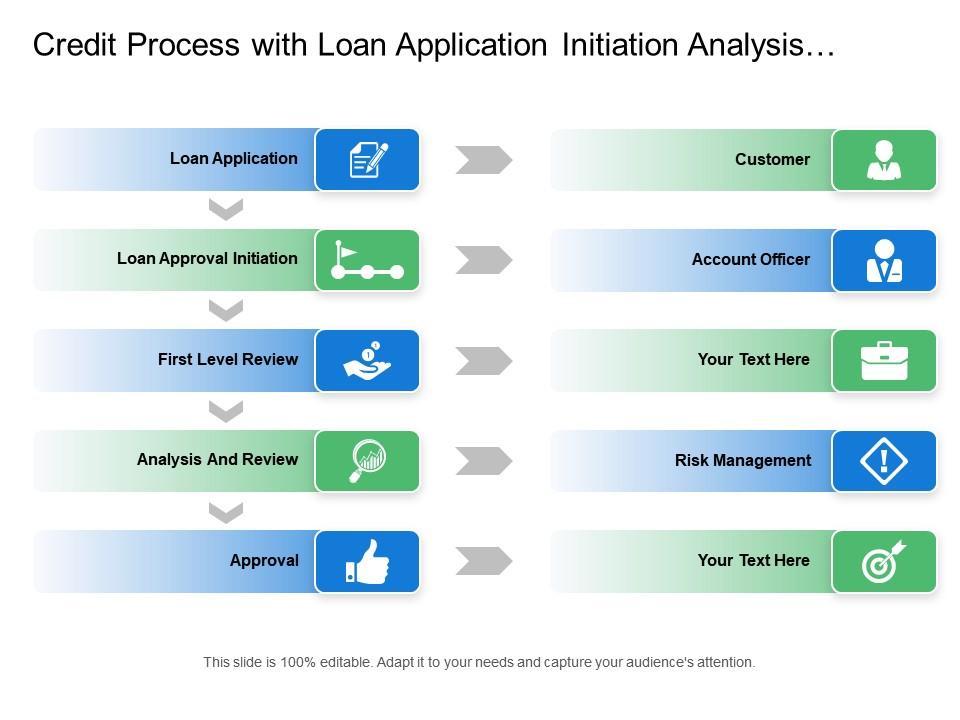

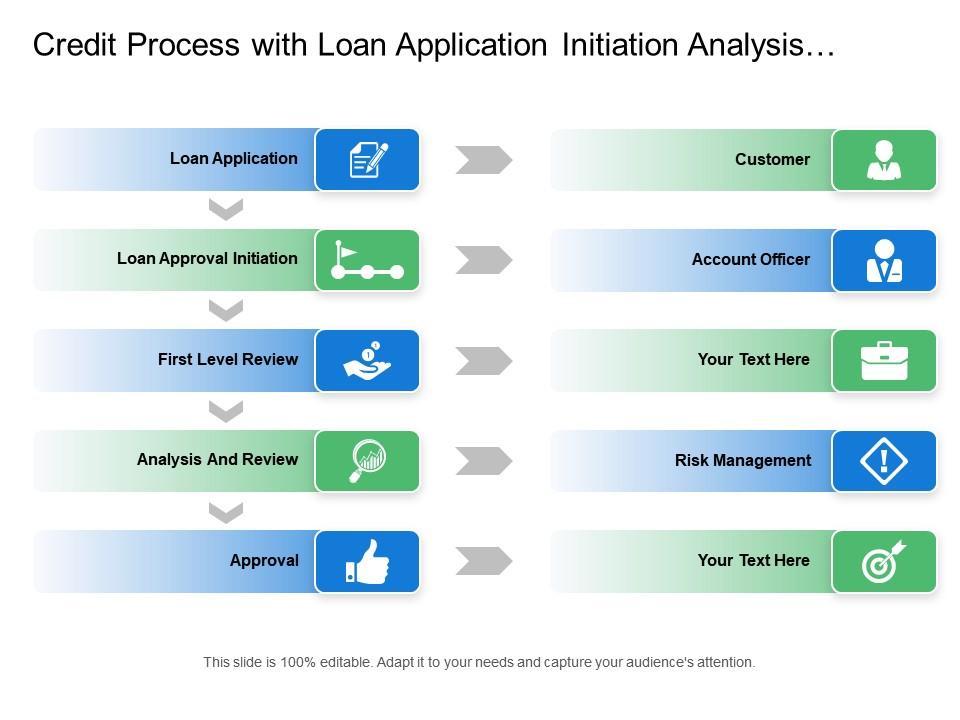

Step 2: Understand the Credit Application Process The credit application process typically involves several steps, including:

- Pre-approval: The lender reviews your credit report and provides a pre-approval amount.

- Application: You submit a formal application, providing personal and financial information.

- Review: The lender reviews your application and credit report.

- Approval: The lender approves or rejects your application.

Understanding the credit application process can help you prepare and increase your chances of approval.

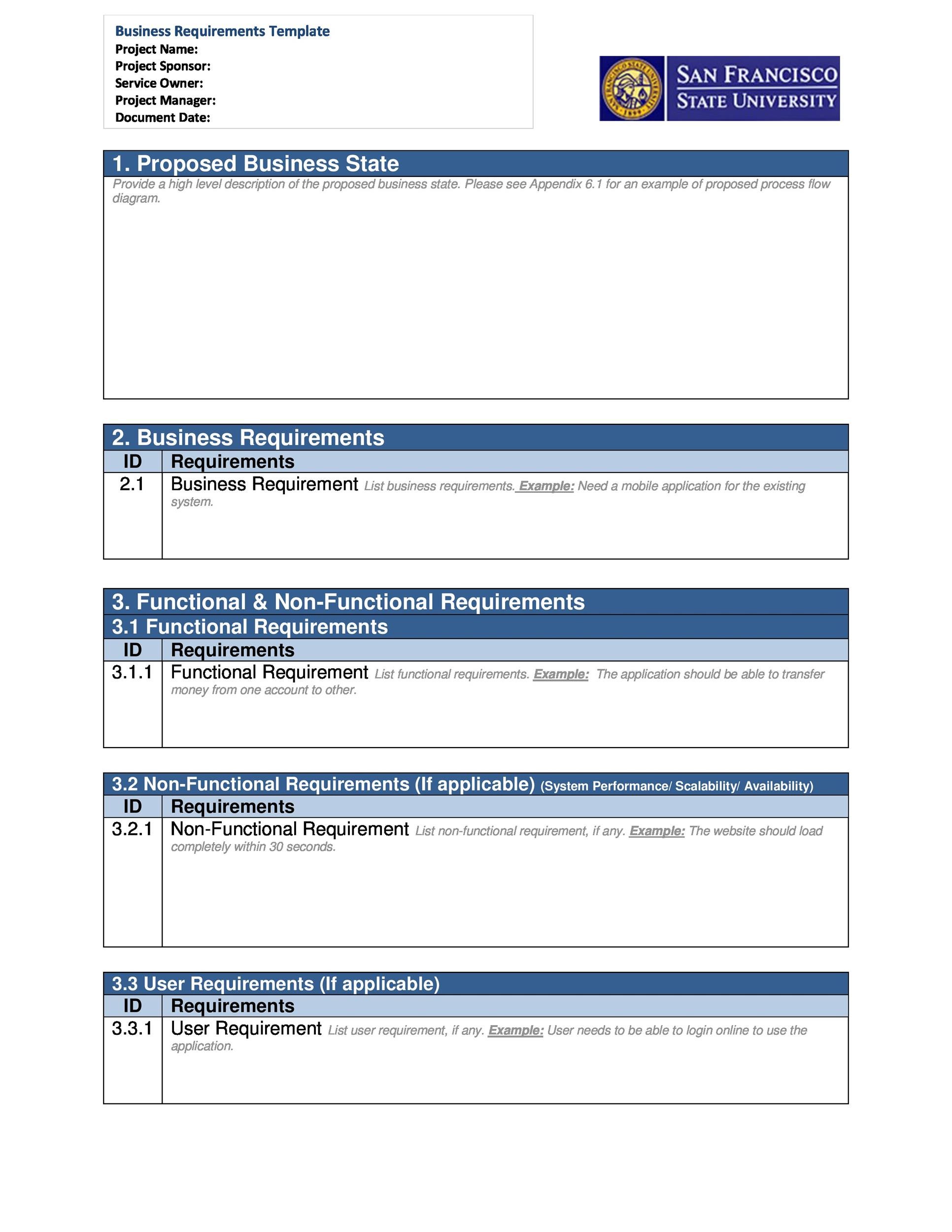

Step 3: Gather Required Documents To apply for credit, you'll typically need to provide personal and financial documents, including:

- Identification (driver's license, passport, etc.)

- Proof of income (pay stubs, W-2 forms, etc.)

- Proof of employment (letter from employer, etc.)

- Bank statements

- Tax returns

Gather these documents in advance to ensure a smooth application process.

Step 4: Choose the Right Credit Product With so many credit products available, it's essential to choose the right one for your needs. Consider the following factors:

- Interest rate

- Fees

- Repayment terms

- Credit limit

Research and compare different credit products to find the one that best suits your financial situation.

Step 5: Submit a Strong Application When submitting your application, make sure to:

- Provide accurate and complete information

- Avoid errors and typos

- Include all required documents

- Follow the lender's instructions carefully

A strong application can make a significant difference in the approval process.

Step 6: Follow Up After submitting your application, follow up with the lender to:

- Confirm receipt of your application

- Ask about the status of your application

- Provide additional information if needed

Following up can help ensure your application is processed efficiently and improve your chances of approval.

By following these six steps, you can increase your chances of a successful consumer credit application. Remember to check your credit report, understand the credit application process, gather required documents, choose the right credit product, submit a strong application, and follow up with the lender. With the right preparation and knowledge, you can set yourself up for long-term financial success.

Gallery of Credit Application Tips

FAQs

What is a credit score, and how is it calculated?

+A credit score is a three-digit number that represents your creditworthiness. It's calculated based on your payment history, credit utilization, credit age, and other factors.

How long does it take to get approved for credit?

+The approval process typically takes a few days to a few weeks, depending on the lender and the complexity of your application.

What can I do if my credit application is rejected?

+If your credit application is rejected, you can try to improve your credit score, apply for a different credit product, or seek assistance from a credit counselor.