Moving into a new apartment can be an exciting yet overwhelming experience, especially when dealing with the uncertainty of the application process. One of the most frustrating experiences is receiving a denial letter after pouring your heart and soul into the application. If you're left wondering why your apartment application was denied, you're not alone. In this article, we'll explore five common reasons why apartment applications are rejected and provide practical tips to help you avoid these pitfalls in the future.

Reason 1: Poor Credit History

A poor credit history can be a major obstacle when applying for an apartment. Landlords use credit scores to assess the risk of renting to a particular tenant. A low credit score can indicate a history of late payments, collections, or even bankruptcy. To avoid this issue, it's essential to:

- Check your credit report before applying for an apartment

- Dispute any errors or inaccuracies on your report

- Work on improving your credit score by making timely payments and reducing debt

Reason 2: Insufficient Income

Landlords typically require tenants to have a stable income that meets their rent-to-income ratio requirements. If your income is insufficient or unstable, your application may be denied. To avoid this issue, consider:

- Providing proof of additional income sources, such as a second job or freelance work

- Including a co-signer with a stable income

- Applying for apartments with more flexible income requirements

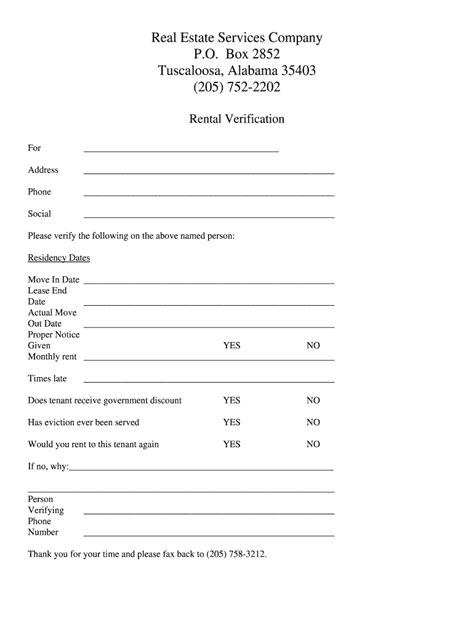

Reason 3: Rental History Issues

A poor rental history can raise red flags for landlords. If you have a history of late payments, evictions, or property damage, your application may be denied. To avoid this issue, consider:

- Providing explanations for any past issues

- Including references from previous landlords or property managers

- Applying for apartments that cater to tenants with imperfect rental histories

Reason 4: Incomplete or Inaccurate Application

An incomplete or inaccurate application can lead to denial. Make sure to:

- Double-check your application for errors or omissions

- Provide all required documentation, including proof of income and rental history

- Follow up with the landlord or property manager to ensure your application is complete

Reason 5: Unstable Employment

Landlords want to ensure that tenants have a stable source of income to make rent payments. If you have an unstable employment history, your application may be denied. To avoid this issue, consider:

- Providing proof of a stable job offer or employment contract

- Including a co-signer with stable employment

- Applying for apartments that cater to tenants with non-traditional employment arrangements

Conclusion

Receiving a denial letter can be disappointing, but it's not the end of the world. By understanding the common reasons why apartment applications are rejected, you can take steps to improve your chances of approval. Remember to:

- Check your credit report and work on improving your credit score

- Provide proof of stable income and employment

- Ensure your application is complete and accurate

- Consider applying for apartments that cater to tenants with imperfect credit or rental histories

By following these tips, you can increase your chances of approval and find the perfect apartment for your needs.

Gallery of Apartment Application Tips

FAQs

What is the average credit score required for an apartment application?

+The average credit score required for an apartment application varies depending on the landlord or property manager. However, a general rule of thumb is to have a credit score of 650 or higher.

How long does the apartment application process typically take?

+The apartment application process can take anywhere from a few days to several weeks. It's essential to follow up with the landlord or property manager to ensure your application is complete and being processed.