Are you looking to expand your business or start a new project, but need financing to make it happen? 84 Lumber is a well-established company that offers credit to qualified customers, helping them achieve their goals. However, the application process can be daunting, and approval is not guaranteed. In this article, we will guide you through the 5 steps to increase your chances of getting approved for an 84 Lumber credit application.

Understanding the Importance of Credit Approval

Before we dive into the steps, it's essential to understand why credit approval is crucial for your business. With 84 Lumber credit, you can:

- Increase your purchasing power and take on larger projects

- Improve your cash flow and manage your finances more efficiently

- Enhance your business reputation and credibility

- Take advantage of special promotions and discounts

Step 1: Check Your Credit Score

Your credit score plays a significant role in determining your eligibility for 84 Lumber credit. A good credit score can help you qualify for better interest rates and terms. You can check your credit score for free on various websites, such as Credit Karma or Credit Sesame. If your score is low, consider working on improving it before applying.

Step 2: Gather Required Documents

To increase your chances of approval, make sure you have all the necessary documents ready. These may include:

- Business license and registration

- Tax ID number and tax returns

- Financial statements, such as balance sheets and income statements

- Personal identification, such as a driver's license or passport

- Proof of insurance and liability coverage

Step 3: Fill Out the Application Accurately

The application process typically involves filling out a form, either online or in-person. Make sure to:

- Provide accurate and complete information

- Avoid errors and omissions

- Use a clear and concise writing style

- Attach all required documents

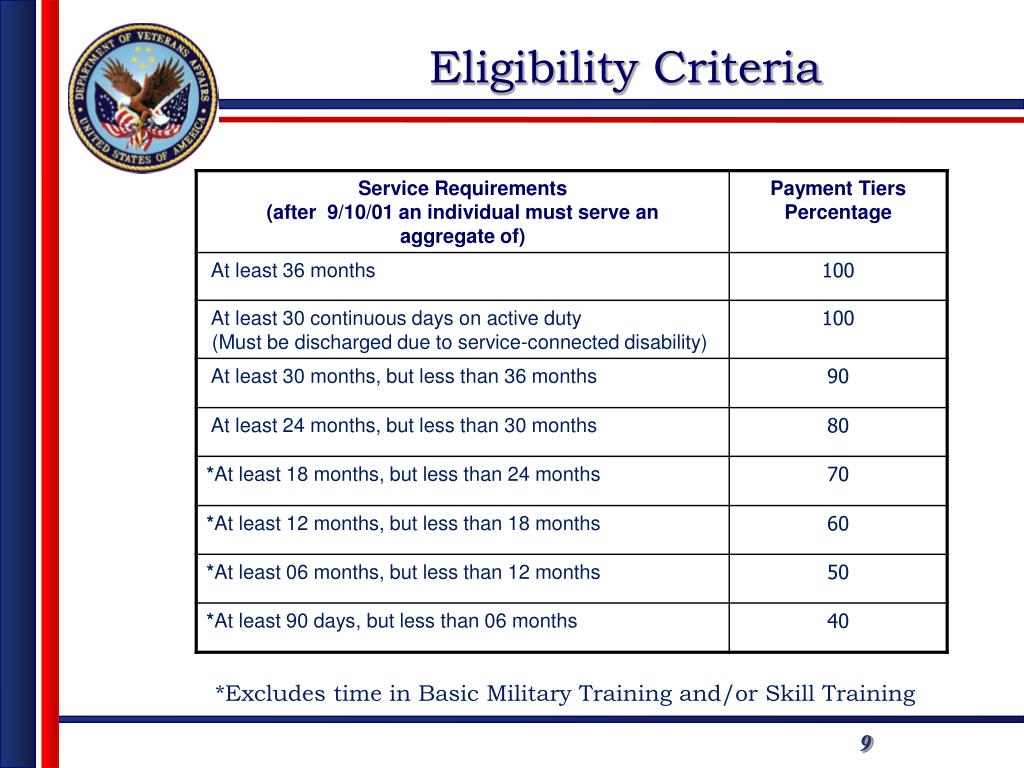

Step 4: Meet the Eligibility Criteria

84 Lumber has specific eligibility criteria that you must meet to qualify for credit. These may include:

- Being a registered business or individual with a valid tax ID number

- Having a minimum credit score or financial history

- Meeting specific income or revenue requirements

- Providing collateral or security for the credit

Step 5: Follow Up and Negotiate

After submitting your application, follow up with 84 Lumber to ensure it's being processed. If you're denied credit, ask for feedback and try to negotiate. You can also consider providing additional documentation or collateral to strengthen your application.

Gallery of 84 Lumber Credit Application

FAQs

What is the minimum credit score required for 84 Lumber credit?

+The minimum credit score required for 84 Lumber credit varies, but typically, it's around 600-650.

How long does the 84 Lumber credit application process take?

+The application process typically takes 2-5 business days, but can vary depending on the complexity of the application.

Can I apply for 84 Lumber credit if I have a bad credit history?

+Yes, you can still apply for 84 Lumber credit, but you may need to provide additional documentation or collateral to strengthen your application.

By following these 5 steps and understanding the importance of credit approval, you can increase your chances of getting approved for an 84 Lumber credit application. Remember to check your credit score, gather required documents, fill out the application accurately, meet the eligibility criteria, and follow up and negotiate. Good luck!